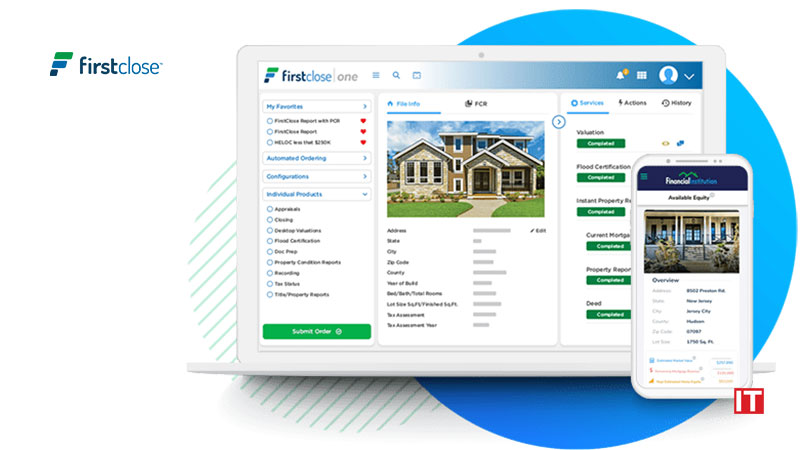

FirstClose, Inc., a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, announced that its end-to-end digital home equity origination solution, FirstClose ONE™ Equity, is now integrated with the MeridianLink® One platform.

FirstClose’s one-of-a-kind equity solution reduces operational touchpoints and improves the overall customer experience for borrowers. The end-to-end platform includes a borrower-facing point-of-sale solution that gives consumers instant online feedback on their home valuation, available home equity, loan options and delivers credit decisions in minutes. Automated workflows, including the ordering of settlement services, enable lenders to complete the application through closing process in five to ten days versus the industry average of 45 to 60 days.

“The MeridianLink partner marketplace is a trusted resource for our customers, and we are thrilled to add FirstClose’s digital HELOC solution to our ecosystem,” said Amy Daniels, senior vice president, Partner Marketplace, MeridianLink. “In the current lending environment, offering more home equity lending capabilities to our customers can help them better meet consumer expectations.”

“We are extremely pleased to deepen our relationship with MeridianLink and to provide a modern, digital home equity solution to its clients,” said Tim Smith, chief revenue officer, FirstClose. “Lenders using our ONE Equity solution have experienced overall time savings as high as 77%, 35% increases in online applications and 25% improvements in pull through.”