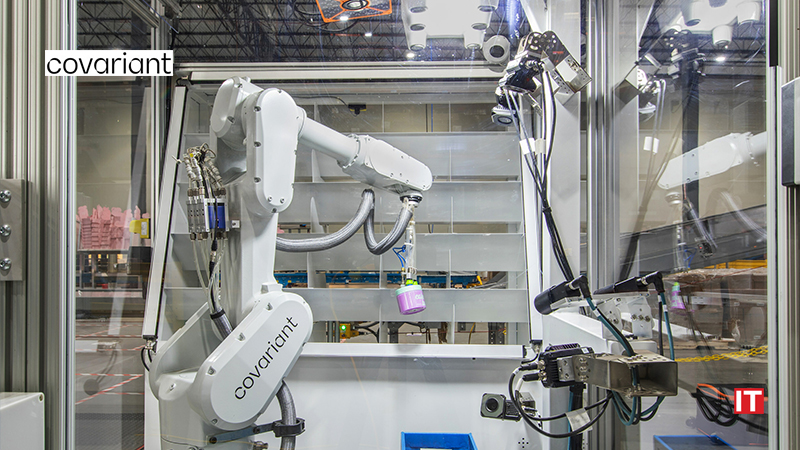

Leading global AI Robotics company, Covariant revealed new survey findings that confirm 2023 is the start of a new operating era for retailers.

Results reveal how despite a looming recession, retailers and their logistics providers are planning to increase investment in automation solutions, including AI Robotics, to optimize operations and revitalize the customer experience — positioning themselves to scoop up customers from less innovative rivals.

Key findings from the report include:

- A new challenge emerges in 2023 — an unpredictable, high-inflation economy. The most impactful material handling challenges that retailers and logistics providers expect in 2023 remain similar to those experienced during the pandemic (from 2020-2022) — except for one change. While supply chain disruptions, bottlenecks, and rising eCommerce growth rates remain concerns this year, retailers foresee the additional challenge of operating in an unpredictable and high-inflation environment.

- Retailers create a competitive advantage through material handling. Despite inflation, economic concerns, and a possible recession, investments in material handling aren’t slowing down. Material handling is considered a way to create valuable differentiation instead of being just a cost center. Half of logistics and retail executives (51%) report that, in 2023, their companies will view material handling as a way to create a competitive advantage — no matter how much it costs.

- Scaled automation investments at brownfield sites are the priority. Instead of focusing on greenfield investments like they might have previously, more than half (56%) plan to shift their 2023 fulfillment and distribution center investments toward maintaining current facility counts while bringing in technology that creates efficiency and automation and upends heavily manual processes.

2023 will also be the year retailers and logistics providers shift from pilot automation projects to the scaled deployment of automation solutions like AI-powered picking robots across entire warehouses and distribution centers. - Three core areas of robotic picking automation emerge supreme. Order picking, packing, and order sortation are the top categories for investments in robotic picking automation this year and through 2025. As a result of these investments, retailers expect to:

- Reduce human labor costs (55%)

- Improve throughput and efficiency (54%)

- Be ready for future dynamic and changing business needs (46%)

- Handle fluctuating demand spikes (43%)

Also Read: Numurus Solves a Critical AI Technology Gap with NEPI

“Retailers are feeling the pressure increase as supply chain challenges from previous years linger and new ones rear their ugly heads. But with the right automation strategy — delivering a cost-effective, great customer experience is completely within reach,” said Peter Chen, Chief Executive Officer, Covariant. “This survey report reveals that success in 2023 will come with scaled deployments of AI robotics to drive down labor costs and improve throughput.”

SOURCE: PR Newswire