TIFIN, the fintech platform known for its highly engaging products fueled by advanced data science and machine learning, has launched a first of its kind platform for client personalization. The platform to facilitate modern personalization will be offered by its TIFIN Wealth division to financial intermediaries in the world of wealth. The announcement marks a significant step in providing access to the type of AI-powered personalization typically seen in major consumer/e-commerce platforms to financial advisory firms of all sizes.

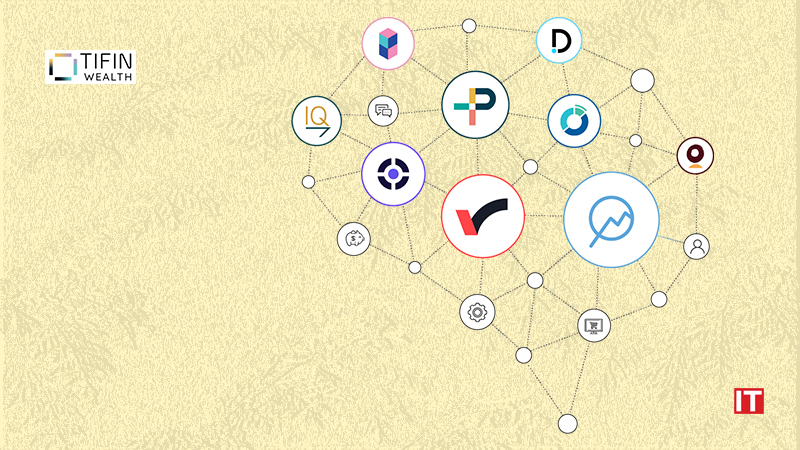

In response to the growing demands of today’s wired investors and their heightened expectation for frictionless, personalized experiences, advisors and their enterprises are searching for personalization at scale that is outcome oriented. TIFIN Wealth integrates over a dozen market-proven capabilities focused on personalizing client engagement, and providing actionable recommendations to advisory firms fueled by real-time business intelligence. The platform answers key questions for wealth managers such as: “Who among my clients or prospects should I focus on?” and “How should I personalize?”

Also Read: Synack Expands Security Platform with Adversarial API Pentesting

Advisors using TIFIN Wealth can build their client’s holistic personas enriched with assessments and data from behaviors, holdings, vendors and CRM. Investment algorithms provide actionable recommendations across various wealth journeys. The platform also facilitates execution and ongoing client engagement. This complete arc enables better matching of clients with investment solutions to drive conversion, retention, and ultimately growth.

Designed with modularity, TIFIN Wealth can be customized for the individual needs of an advisory firm. These capabilities are also available in a suite of APIs that can plug into the existing wealthtech stacks or as practice management capabilities for wealth and asset management firms.

“We are delighted to bring TIFIN Wealth to the market,” said Niharika Shah, Chief Growth Officer, TIFIN Wealth. “The wealth management industry can now harness the power of personalization and real-time intelligence to drive growth similar to consumer-oriented platforms. We believe this platform is a huge step in advancing the industry’s heightened focus on client-centricity in a modern way.”