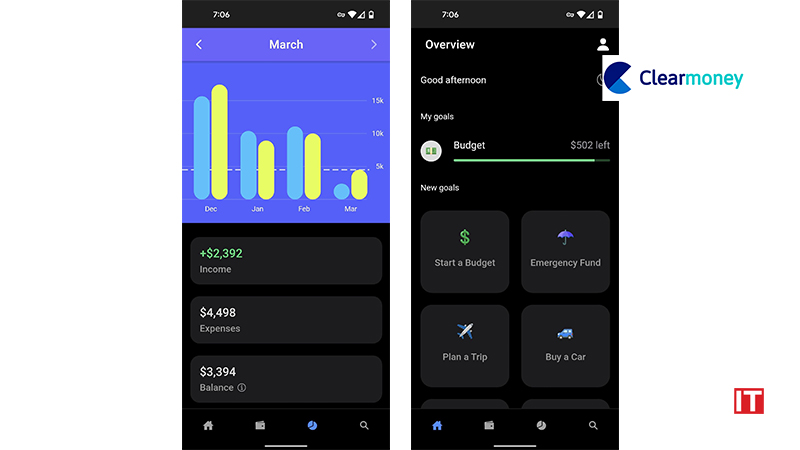

Startup company ClearMoney unveiled its new flagship app to help Americans grapple with stagnate wages and the worst inflation rates in over four decades. Developed by experts from top mega-tech companies like Google, Netflix, Dropbox, Lyft, and DoorDash, ClearMoney is a new budgeting and financial planning tool that lets users see all their accounts and financial goals in one place.

ClearMoney: Take Control of Your Money

- Proven method. The app applies the 50/30/20 rule to help its users maintain financial health.

- Track all your spending in one place and know exactly where your money is going with real-time alerts and reminders. Supports all U.S. financial institutions.

- Flexible budgeting. The app automatically categorizes your expenses and recommends realistic monthly and weekly budgets.

- Review recent spending, check when bills are coming, and automatically set cash aside for goals.

- Analyzes spending across merchants, categories, recurring bills, and more and tells you how much you can afford to spend.

- Loan calculator that estimates monthly payments on a new home or auto purchase.

- Plan for large purchases and life’s important moments. Whether it’s a dream home, a vacation, retirement, or your child’s education, know how close you are to meeting your goals.

- Prevent overdraft fees, pay off debt, and build better credit over time. Gain peace of mind.

“We believe financial guidance should be accessible and tailored to personalized goals,” said Adrian Cruz, co-founder of ClearMoney.

“We aim to help our users achieve their goals through personalized insights, reminders, and positive reinforcement – while enabling them to visualize everyday spending patterns from every account across different financial services, updating in real-time seamlessly and effortlessly. Money doesn’t have to be messy.”